Raise Your Know-how with Bagley Risk Management

Raise Your Know-how with Bagley Risk Management

Blog Article

Just How Animals Risk Security (LRP) Insurance Coverage Can Secure Your Livestock Financial Investment

In the world of livestock financial investments, mitigating dangers is vital to making certain financial security and development. Livestock Threat Protection (LRP) insurance policy stands as a reputable shield against the unpredictable nature of the marketplace, providing a critical method to securing your possessions. By diving into the complexities of LRP insurance and its complex advantages, animals manufacturers can strengthen their investments with a layer of security that goes beyond market changes. As we discover the world of LRP insurance policy, its duty in securing animals financial investments ends up being increasingly apparent, promising a course towards lasting financial durability in an unpredictable industry.

Comprehending Livestock Danger Security (LRP) Insurance

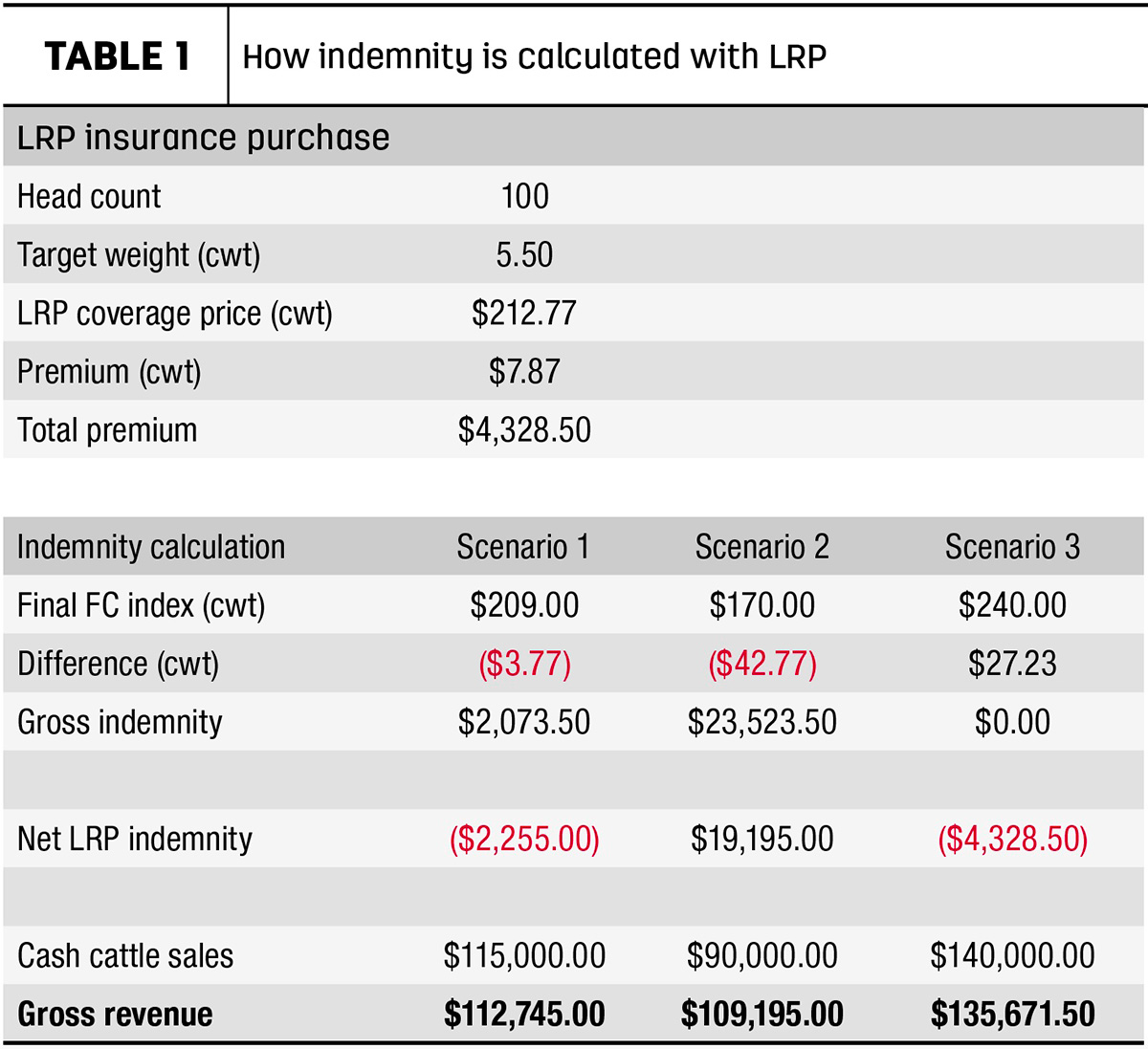

Recognizing Livestock Danger Protection (LRP) Insurance coverage is crucial for livestock manufacturers looking to reduce financial risks related to cost changes. LRP is a federally subsidized insurance coverage product created to shield manufacturers against a decrease in market value. By offering coverage for market value declines, LRP helps producers secure in a flooring rate for their animals, guaranteeing a minimum degree of revenue despite market fluctuations.

One secret facet of LRP is its versatility, enabling manufacturers to tailor coverage degrees and plan sizes to match their specific demands. Producers can choose the variety of head, weight array, coverage price, and coverage period that line up with their manufacturing objectives and take the chance of tolerance. Comprehending these adjustable choices is essential for manufacturers to properly handle their price risk exposure.

Additionally, LRP is offered for numerous livestock types, consisting of livestock, swine, and lamb, making it a versatile risk monitoring tool for animals manufacturers throughout different industries. Bagley Risk Management. By familiarizing themselves with the details of LRP, manufacturers can make educated decisions to guard their investments and make certain economic security in the face of market unpredictabilities

Benefits of LRP Insurance for Animals Producers

Livestock producers leveraging Livestock Threat Protection (LRP) Insurance gain a calculated benefit in securing their investments from cost volatility and safeguarding a steady monetary ground among market unpredictabilities. By establishing a floor on the cost of their livestock, manufacturers can mitigate the threat of considerable financial losses in the event of market recessions.

Furthermore, LRP Insurance gives manufacturers with assurance. Knowing that their financial investments are guarded against unexpected market adjustments enables producers to focus on various other elements of their company, such as improving pet wellness and welfare or optimizing production procedures. This peace of mind can cause raised efficiency and productivity in the future, as producers can run with even more self-confidence and security. On the whole, the benefits of LRP Insurance coverage for animals producers are significant, using a useful tool for managing danger and ensuring economic protection in an uncertain market setting.

Just How LRP Insurance Mitigates Market Threats

Reducing market dangers, Livestock Risk Protection (LRP) Insurance gives animals manufacturers with a reputable shield against price volatility and economic uncertainties. By offering defense against unanticipated price declines, LRP Insurance coverage helps manufacturers secure their financial investments and maintain economic stability in the face of market variations. This sort of insurance allows animals producers to secure a price for their pets at the beginning of the policy period, making certain a minimum cost degree regardless of market adjustments.

Steps to Secure Your Animals Financial Investment With LRP

In the world of agricultural risk find out here management, carrying out Animals Risk Defense (LRP) Insurance includes a calculated procedure to safeguard investments against market variations and uncertainties. To secure your livestock investment successfully with LRP, the initial action is to assess the particular dangers your procedure encounters, such as rate volatility or unanticipated weather events. Next, it is crucial to research and select a trustworthy insurance service provider that provides LRP policies customized to your animals and business needs.

Long-Term Financial Security With LRP Insurance

Ensuring enduring financial stability via the application of Animals Danger Security (LRP) Insurance coverage is a prudent long-term strategy for farming manufacturers. By integrating LRP Insurance coverage into their threat monitoring plans, farmers can protect their livestock financial investments versus unanticipated market fluctuations and adverse events that could threaten their monetary well-being over time.

One trick benefit of LRP Insurance for lasting economic safety and security is the satisfaction it supplies. With a trusted insurance coverage in position, farmers can reduce the financial dangers associated with unpredictable market conditions and unexpected losses because of aspects such as illness outbreaks or all-natural disasters - Bagley Risk Management. This security allows manufacturers to focus on the day-to-day procedures of their livestock service without constant fret about possible financial obstacles

Furthermore, LRP Insurance policy offers an organized approach to handling risk over the long term. By establishing particular protection degrees and picking ideal recommendation periods, farmers can tailor their insurance prepares to straighten with their financial goals and take the chance of resistance, guaranteeing a lasting and secure future for their livestock operations. To conclude, buying LRP Insurance coverage is an aggressive approach for agricultural producers to accomplish long-term economic protection and safeguard their source of incomes.

Verdict

In conclusion, Livestock Threat Security (LRP) Insurance coverage is an important tool for livestock manufacturers to alleviate market dangers and secure their investments. It is a smart choice for safeguarding animals investments.

Report this page